Get a Callback

CA Offline Courses at Kisalay Commerce Classes

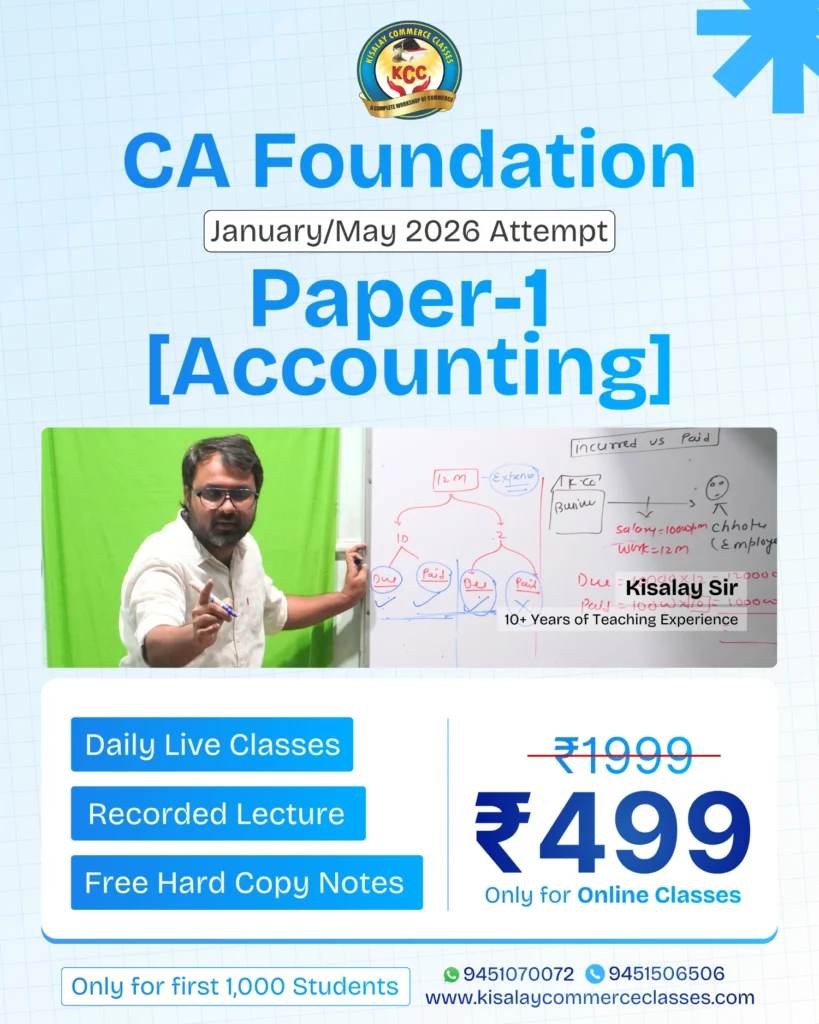

Welcome to Kisalay Commerce Classes (KCC) in Prayagraj, your trusted partner in achieving success in the Chartered Accountancy (CA) journey. Our offline CA courses are designed to provide comprehensive guidance, expert teaching, and a supportive learning environment to help you excel in CA Foundation, Intermediate, and Final levels. With a proven track record and student-focused approach, KCC is the ideal choice for aspiring Chartered Accountants.

Our CA Offline Courses

Kisalay Commerce Classes offers offline coaching for all three levels of the Chartered Accountancy (CA) program conducted by the Institute of Chartered Accountants of India (ICAI). Each course is tailored to meet the specific needs of students at different stages of their CA journey, ensuring a strong foundation, in-depth knowledge, and exam-ready preparation.

Why Choose KCC for Your CA Journey?

At Kisalay Commerce Classes, we are committed to shaping your career in finance and accounting. Our offline CA courses in Prayagraj offer a structured learning experience customize to meet the demands of the CA curriculum set by the Institute of Chartered Accountants of India (ICAI). Here’s what sets us apart:

5-Day Free Trial Classes

Experience our teaching methodology and classroom environment before committing, with no cost for the first five days.

Comprehensive Study Material

Receive detailed, up-to-date study resources designed to cover the entire CA syllabus, ensuring you are well-prepared for exams.

Expert Faculty

Learn from highly qualified and experienced instructors, including Chartered Accountant and industry professionals, who provide clear explanations and practical insights.

Digital Classrooms

Study in modern, technology-enabled classrooms that enhance learning through interactive tools and engaging sessions.

Personalized Guidance

Benefit from one-on-one counseling and progress tracking to stay on the right path toward success.

Flexible Learning Environment

Our offline classes balance rigorous preparation with a supportive and motivating atmosphere.

Detail information about Course Structure of CA

CA Foundation (Entry Level)

The CA Foundation is the entry-level examination for students who wish to pursue Chartered Accountancy after completing Class 12. It introduces students to the basics of Accounting, Business, Law, and Economics and acts as the first step in the CA journey.

Eligibility: Completed Class 12 from a recognized board

Exam Attempts: Held thrice a year (January,May & September)

Duration: Minimum 4-month study period post-registration

Subjects (4 papers) :

- Accounting

- Business Laws

- Quantitative Aptitude (Maths, Logical Reasoning, Statistics)

- Business Economics

Exam Pattern:

- A mix of Objective and Subjective questions

- Negative marking applicable in objective-type questions

Passing Criteria: Minimum 40% per paper, and at least 50% aggregate

CA Intermediate (Second Level)

CA Intermediate is the second level of the Chartered Accountancy course. It builds upon the concepts learned in Foundation and introduces deeper knowledge in core subjects like Accounting, Taxation, Law, and Financial Management. It is also the stage that leads to practical training (Articleship).

Direct entry for graduates (Commerce ≥55%, Other streams ≥60%)—exempts Foundation

After Foundation: Students may register post passing Foundation

Exam Attempts: Twice yearly (May & November), and from 2025 onwards thrice yearly (Jan/May/Sep)

Structure: Two groups, each with 3 papers (total 600 marks; 70% subjective, 30% objective)

Group I:

Advanced Accounting

Corporate & Other Laws

Taxation (Income Tax & GST)

Group II:

Cost & Management Accounting

Auditing & Ethics

Financial Management & Strategic Management

Passing Criteria: 40% in each paper and 50% in aggregate per group

Exemptions: Scoring ≥60% in a paper grants exemption for up to 3 subsequent attempts

Articleship Trigger: After clearing BOTH groups and completing ICAI orientation & ITT modules, candidates begin a 2-year Articleship

CA Final (Final Level)

The CA Final is the last and most advanced stage of the Chartered Accountancy course. It focuses on specialization in subjects like Financial Reporting, Strategic Management, Taxation, and Auditing. It prepares students for leadership roles in finance, accounting, and consultancy.

Eligibility: Must clear both Intermediate groups & complete Articleship

Exam Attempts: Twice yearly (May & November)

Structure: Two groups, each with 3 papers (6 papers total)

Group I:

Financial Reporting

Advanced Financial Management

Advanced Auditing, Assurance & Professional Ethics

Group II:

Direct Tax Laws & International Taxation

Indirect Tax Laws (GST + Customs & FTP)

Integrated Business Solutions

Passing Criteria: 40% per paper and 50% aggregate per group

MCQ Component: 30 marks of MCQs per paper (Paper 6 has 40)

Exemption Rule: ≥60% in any paper grants permanent exemption from that paper

Articleship & Practical Training

Duration: Mandatory 2-year Articleship under a practicing Chartered Accountant

Orientation & ITT Courses:

A 15-day orientation + Information Technology Training (ITT) before starting Articleship

Two advanced modules (AICITSS, MCS) before CA Final

Quick Comparison Table

| Level | Papers | When | Eligibility |

| Foundation | 4 | Jan/May/Sep | Class 12 |

| Intermediate | 6 | Jan/May/Sep | After Foundation or direct-entry for grads |

| Final | 6 | May, Nov | After both Inter groups + Articleship |

Teaching Method for KCC CA Batch

| Component | Details |

| Daily Classes | 3-4 hours of interactive sessions (morning/evening batches) |

| Weekly Tests | Topic-wise tests to monitor progress, build exam stamina, and identify improvement areas. |

| Doubt-Clearing | Post-class sessions (offline/online) for instant query resolution. |

| Study Materials | – Printed Notes: Curated with key concepts and formulas. – Practice Workbooks: Exercises for reinforcement. – Question Banks: Past exam questions. – Online Resources: Recorded lectures and revision notes. |

KCC CA Batch Details

| Aspect | Details |

| Batch Focus | CA [Foundation, Intermediate, Final] |

| Duration | Valid until January 2026 Exams |

| Subjects Covered | Related to the Course |

| Learning Approach | Bilingual (Hinglish), Interactive Classes |

| Examination | As per the ICAI guidelines |

| Study Materials | Printed study modules, with detailed text solutions, free welcome kit for online and offline classes |

| Support | 24/7 online and in-person doubt support, mock tests, performance analysis with report cards, student help desk |

| Digital Access | *Recordings on KCC App |

| Fee Policy | Non-refundable fees for study materials and registration |

| Contact | Call +91-9451070072 for details orinfo@kisalaycommerceclasses.com |

Admission Process for 2025

Joining our CA Offline Courses is simple:

- Visit Our Institute: Come to Kisalay Commerce Classes at 10A/8A Near Patrika chauraha, Tashkand Marg, Civil lines, Prayagraj.

- 5-Day Free Trial Classes: Experience our teaching methodology and classroom environment at no cost for the first five days.

- Counseling Session: Discuss your goals with our academic counselors to choose the right course.

- Registration: Complete the registration form and submit required documents (ID proof, academic certificates).

- Fee Payment: Pay the course fee via cash, UPI, or bank transfer. Installment options available.

- Start Learning: Attend your first class and begin your CA journey with KCC!

Note: Early registration for 2025 batches is recommended due to limited seats. Book Your Seat Now!

Testimonials

Happy Students Happy Us

EXCELLENTTrustindex verifies that the original source of the review is Google. Its a best coaching for commerce students.Yaha ke teachers bahut supportive hai.Trustindex verifies that the original source of the review is Google. One of the best and super dedicated faculty for all commerce students with the personalized guidance and suggestions for academic as well as personality growth of a student.Trustindex verifies that the original source of the review is Google. Excellent platform for ur goals...best coaching for commerceTrustindex verifies that the original source of the review is Google. Best mentor with friendly environment Higly appreciate the effort..Trustindex verifies that the original source of the review is Google. Bestest Institute for commerce.. To achieve ur aim Truly appreciate the efforts of our mentors.. Thank uTrustindex verifies that the original source of the review is Google. Good coaching.. poor communication skills from officials about important notifications.Trustindex verifies that the original source of the review is Google. There is legend woh teach us respected kislaya sir He is the best teacher in accountancy I have no more words to say great coaching 🥳🥳🥳